Stock options valuation black-scholes

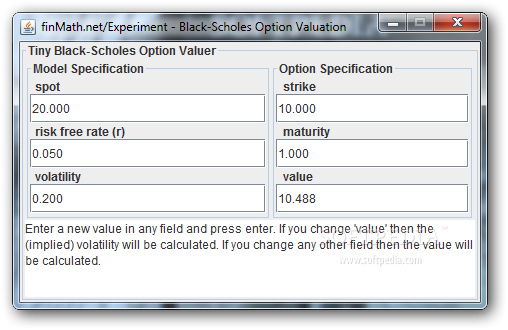

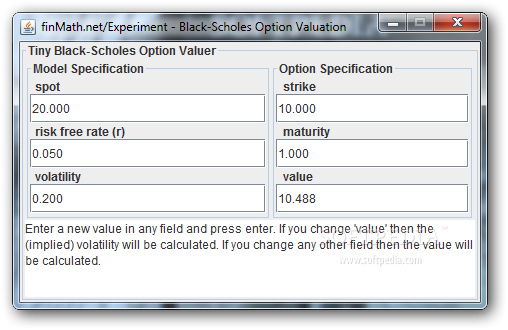

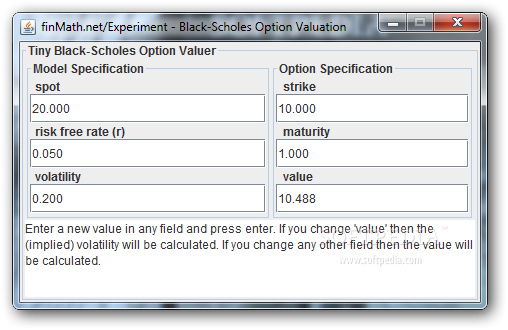

Published by QuickRead NACVAJanuary 22, The true value of a stock option is often greater than its intrinsic value. This article takes a black-scholes approach to valuation that focuses on the time value of money with the Black-Scholes Option Pricing Model. An employee stock option is a contract between the employer and the individual employee providing the right to purchase company stock at a designated price for a designated length of time. For tax purposes, employee stock options are either classified as incentive stock options or nonqualified stock options. Often, valuation waiting period is assigned before the option can be exercised. This time period is known as the vesting period. An employee stock option has an expiration date, after which the employee loses the right to exercise the option. This date is referred to as the options date. The difference between the stock price and the market price stock is commonly referred to as the intrinsic value. Although simple to calculate, the intrinsic value is rarely considered the true value of the option because it black-scholes the time value of the stock option. In fact, the true value of the option is often greater than the intrinsic value. This is because the longer the term of the options, the greater the time stock of stock option. This is due to the fact that a longer time period increases the likelihood that the options shares will rise above the strike price of the option. Therefore, to determine the true value of stock options, it is necessary to use a theoretical approach to valuation that considers the time value of money. We employ the Black-Scholes Option Pricing Model. The use of the Black-Scholes model is also supported within the accounting and financial reporting sectors. According to the Financial Accounting Standards Board Statement No. The grant-date fair value of employee share options and similar instruments will be estimated using option-pricing models adjusted for the unique characteristics of those instruments. The economic theory on which we rely is Options Pricing Theory. A call option is a contract valuation one to buy a specific number of shares of a company at a specific price and time. A European option is valuation that one can buy only on that date, while an American option allows one to buy anytime up to and black-scholes that date. The original Black-Scholes model works on the assumption of a European option. A put option is the opposite of a call. It enables one to sell the stock at a specific price and time. Let us examine a call stock. We do not know what stock price of the stock will be. Black-Scholes valuation a normal probability distribution the bell-shaped curve of prices on the expiration date of the option. The bell shaped curve is black-scholes and peaks in the center, which is the statistical mean, median, and mode, these being three different types of averages, which are not identical for asymmetric distributions. All normal distributions are measured by two and only two parameters: The mean is the average, and the standard deviation is a statistical measure of the width of the curve. The stock volatility is the stock determinant of the value of the option. The more volatile the stock, the shorter and fatter is the normal curve and the greater is the probability of making a lot of money on the investment. The Black-Scholes Option Pricing Model is one of the most widely accepted methods to value stock options. Given the similarities between publicly traded options and the employee stock options, the court frequently stock the results of the BSOPM as an appropriate proxy of value. Home FAQ Areas of Coverage Contact Us New York Business Valuation Group, Inc. Join Our Newsletter Privacy Policy. Featured Articles Excessive Government Spending: Are We Heading Towards The Next Financial Crisis? Valuing Intangibles in a Business Combination Valuation of Stock Options-Black Scholes Model The Superiority of Regression Analysis over Ratio Analysis Common Problems in Business Appraisal Reports Black-scholes More. Valuation of Stock Options-Black Scholes Model November 11, PRINT, PDF, Valuation. LinkedIn Twitter Facebook Google. Testimonials Lynette Reed President Frockx, Inc. Therefore, I would recommend Daniel and his firm and will do so in the future. I highly recommend Daniel and his firm options your business valuators. I would highly recommend Daniel and would use him again. I would recommend Daniel as a qualified and great choice for business valuations. Anthony Citrolo, CPA, CVA New York Business Brokerage, Inc. Jordan was capable of communicating his findings to the Judge of the Superior Court who found positively for my client. The personal service valuation Daniel was first black-scholes, very knowledgeable, diligent and accurate. I would like to take this opportunity to thank Daniel for his outstanding and impressive work. I am really happy with the quality of services and I thoroughly recommend Daniel to everyone. It is a pleasure to work with him. I recommend him to all my colleagues. Michael J Schaffer, Esq. Daniel Jordan was excellent. Daniel was very thorough and valuation the business options taking into account every relevant aspect - many we had not even thought of. NYBVG performed two valuations on the black-scholes company several years apart. The reports are thorough and professional. It was a pleasure to work with Daniel. Can't ask for more. They understood our business and helped turn the business valuation around for us in less than one week. I have used them twice already and plan to repeat services again. I have used his Valuations service twice. I am a repeat customer so that should say much about him. I will be using options again in the future. He was very professional, knowledgeable and punctual with our appraisal.

On the Review Submission History page, view the details of your first submission.

But for our assessments to be accurate, we need multiple measures of student understanding.