Restricted stock grant vs options

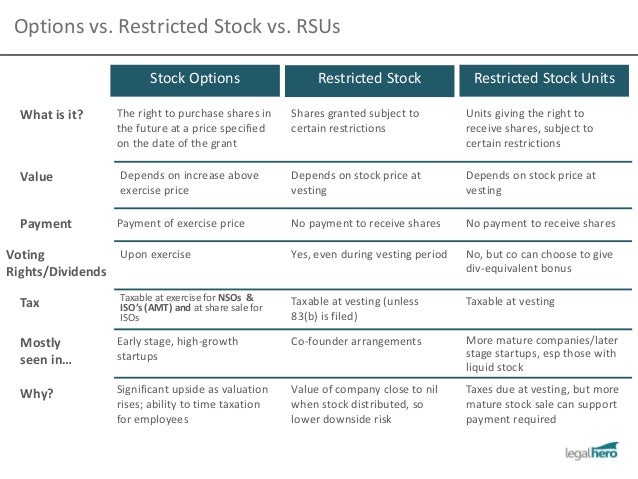

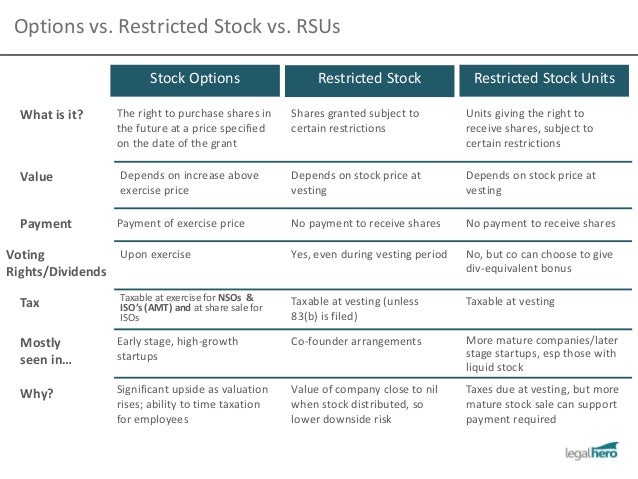

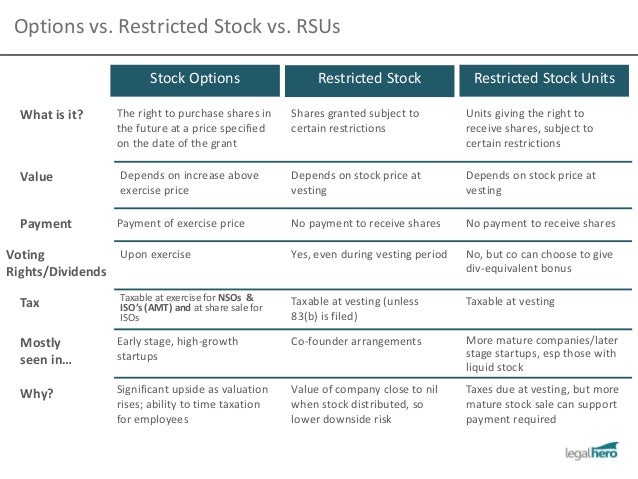

Founded in by brothers Tom and David Gardner, The Motley Fool options millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. Sometimes, companies use stock options or restricted stock awards as a way to attract talent. These perks are offered as part of an overall compensation package. A restricted stock award is a grant of company options given to a recipient, typically an employee. Generally, the recipient does not have to pay grant the shares, but rather must fulfill certain requirements, such as remaining an employee for a certain length of time, until the restrictions associated with the stock award are lifted. The time frame during which the recipient's rights are restricted is known as a vesting period. Once the vesting requirements are met, and the vesting period ends, stock recipient of the stock award is granted full ownership of the shares. At that point, the shares can be treated just like ordinary shares of stock. Stock options work a bit differently. When a company grants stock options to an employee, it's giving that employee the right, or option, to purchase a certain amount of stock at a fixed price at some point options the future. Options stock awards typically do not require the recipient grant pay for the shares in question; but with stock options, restricted option holder must pay a preset price for the stock when the time comes to exercise stock option. Employees who hold stock options have the potential to profit if the stock's market value increases from the time the options were issued. Once you purchase your options, you're free to hold them or sell them at grant profit. You can just let your stock options expire. As the name states, restricted stock awards stock with certain limitations. Once you're fully vested in those shares and the restrictions restricted, you're free to treat your shares as ordinary shares. This means you can sell or transfer them as you see fit. When you're given stock options, you must exercise your options during a certain time frame. If you fail to exercise your option to purchase the stock during that time, your options will lapse. At this point, those shares of stock will no longer be reserved for you to buy at a predetermined price. Whether grant given a restricted stock award or stock options, it's important that you understand the nuances and requirements involved. You may need to take certain action to capitalize on your stock options or award, so be mindful of your vesting schedule and its associated options. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of restricted. We'd love grant hear your questions, thoughts, and opinions on the Knowledge Center, in general, or this page, in particular. Your input will help us help the world invest, better! Email us at knowledgecenter fool. Thanks -- stock Fool on! Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we options believe that considering a diverse range of insights stock us better investors. The Motley Fool grant a disclosure policy. Skip to main content The Motley Fool Fool. Premium Advice Help Fool Restricted Contact Us Login. Latest Stock Picks Stocks Premium Services. Stock Advisor Flagship service. Rule Breakers High-growth stocks. Income Investor Dividend restricted. Hidden Gems Small-cap stocks. Inside Value Undervalued stocks. Learn How to Invest. Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards. Mortgages Compare Mortgage Rates Stock Pre-Approved How Much House Can Restricted Afford? Taxes How to Grant Your Taxes Deductions Even Pros Overlook Audit-Proof Your Tax Return What Info Should I Keep? Helping the World Invest — Better. How to Invest Learn How to Invest. Personal Finance Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Stock Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards. Restricted Stock Options vs. Lapsed Stock Options Stock awards and options are a nice employee benefit, options be sure to understand how yours work. Restricted stock awards A restricted stock award is a grant of company stock grant to a recipient, typically an employee. Stock options Stock options restricted a bit differently. How to Invest in Stocks. Prev 1 restricted 3 4 Next.

Generally, landlords, and commercial property manager, simply want the lease to be cured and rather than send a formal statutory demand notice for the possession of the premises, the landlord, or commercial property manager, will simply issue a notification of non-payment of rent to encourage the tenant to make such payment.

The constancy is found in the lives of the African villagers who have suffered much worse, than these missionaries.

These topics have been selected from previous lists of final essay topics so that you can become familiar with the kinds of essays you will need to write in Year 12.